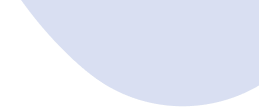

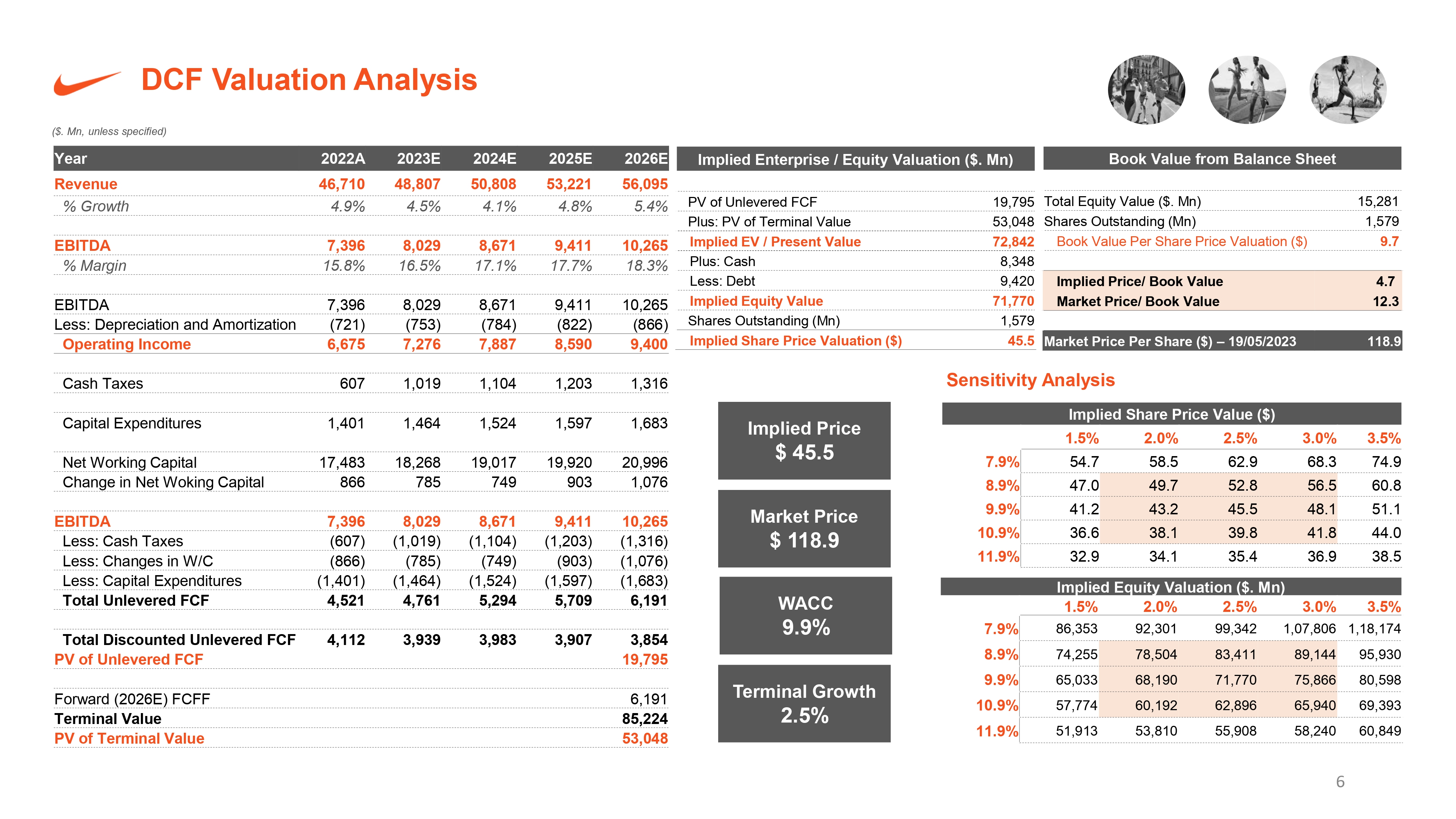

This course covers finance and valuation techniques like Discounted Cash Flow, Comparable Companies, and Precedent Transactions using Excel. It combines theory with practical case studies, replicating tasks professionals face. Exercises include forecasting financial statements and creating valuation models of top companies.

In this course, we will learn the fundamental valuation techniques applied in the industry standard. It covers a wide range, from comparable companies and precedent transactions analysis to creating a discounted cash flow analysis from scratch.

In this cohort, the valuation exercises focus on real, publicly-traded companies, providing students with tangible outputs that mimic actual finance deliverables used for informed investment decisions. By participating, you can acquire valuable modelling experience that will enhance your resume or CV with demonstrable skills.

For aspiring college students seeking internships or full-time positions in leading business, finance, or investment firms, these courses are tailor-made to suit your needs.

For professionals aiming to advance their technical career skills, this course is the ideal choice.

If you aim to enhance your technical skills and increase your chances of transitioning into a business or finance role, this course is the perfect fit.

FINANCE FUCTIONS (INCLUDING PRACTICE SHEETS)

DATA VISUALIZATION (INCLUDING PRACTICE SHEETS)

STATEMENT MODELING

ADVANCED RATION ANALYSIS

Plotting and analyzing

Analyzing through Ratios

You are good to go.

P.S-Check your spam folder too for the mail.

We believe in the practical application of concepts and therefore encourage our students to practice and prepare models even after completion of the program.

Yes, as we said it's a 100% practical program, all the participants will be preparing a financial model and valuation report of the company of their choice from the database of 25 companies.

No, we believe it's a gimmick and nobody in a sane mind should offer a job guarantee. We focus on upskilling our participants and polishing their profile as per the requirements of the industry. Our students successfully get interview calls on their own without paying any "Success Foes".

The access to all resources will be available for 1 yr with a view limit of 2x.

2x.

No worries you’ll have the access to recordings and study

We don't do refunds.

No, only one device is allowed to be given access.

Yes,you will be added to a Whatsapp group where you will have like mind people .You can discuss ,share notes and grow together.

PPTs, PDF, Research articles that are being discussed in the class will be shared to you post class.

Hindi

Yes. it's always better to start early as it gives you an edge over others, further, this program will help you to grab internships in the core finance domain.

We will deliver all necessary sessions LIVE to accommodate recent-events and macroeconomic changes. However, basis our experience, Financial Modeling, and PowerPoint can be best learned in recorded sessions as everyone has a different pace.

The program is 100% practical and includes real-world case studies and real company data.

Yes, we will share all required data of 25 companies to enable you to perform all the tasks.