200+ Hours

Hands on lecture

Hands on lecture

Learn at your own pace

Detailed excel models & more

On course completion

Valuation Methods

Financial Modeling

Excel

DCF & Multiples

Financial Statements

Report Writing

Interview Prep

Case Studies

This program covers the core skills every finance professional needs — from building complete financial models and valuing companies (DCF, comparables, precedent transactions) to mastering Excel shortcuts and financial statement analysis. You’ll work on real company case studies, create professional valuation reports, and learn how to present insights with clarity. Beyond technical skills, the course also focuses on resume building, LinkedIn optimization, and interview preparation — giving you the confidence and expertise to break into equity research, investment banking, or corporate finance roles.

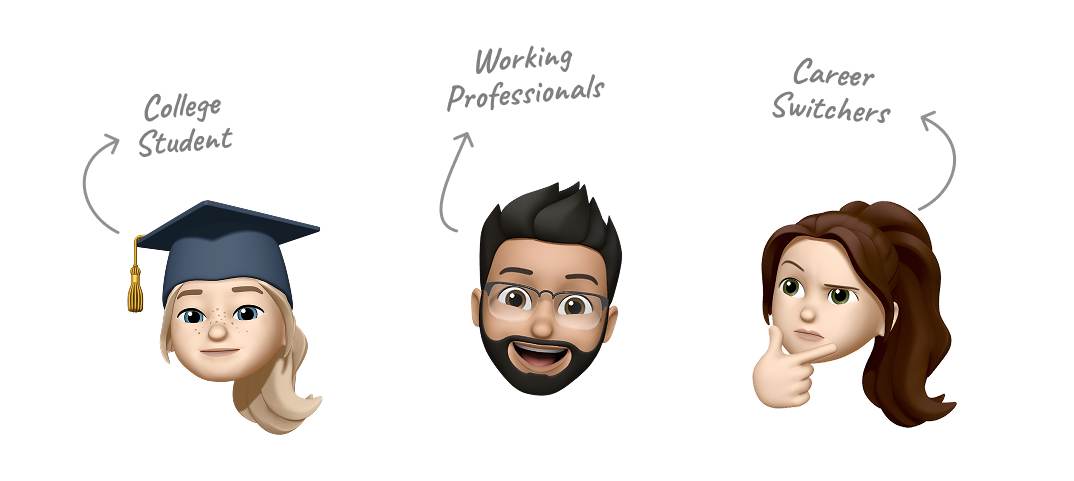

Designed for college students seeking internships or entry-level positions in top finance and investment firms

Ideal for professionals looking to enhance their expertise and advance in their finance careers.

Perfect for those looking to transition into finance by strengthening their expertise

Please drop us a message here to help us resolve it.

Chat on

WhatsApp

Schedule

a Call

Leave

a Mail