200+ Hours

Hands on lecture

Hands on lecture

Learn at your own pace

Detailed excel models & more

On course completion

Financial Statement Analysis

Corporate Governance

Sector Analysis

Advanced Ratios

Annual Reports

Concall Analysis

Report Writing

Interview Prep

You’ll learn how to analyze financial statements and use ratios to understand a company’s health. The cohort trains you to spot forensic red flags and evaluate corporate governance for hidden risks. You’ll also practice reading annual reports concalls and study the economy and sectors that shape businesses. By the end, you’ll create a full equity research report and gain the presentation, resume, and interview skills needed for finance roles.

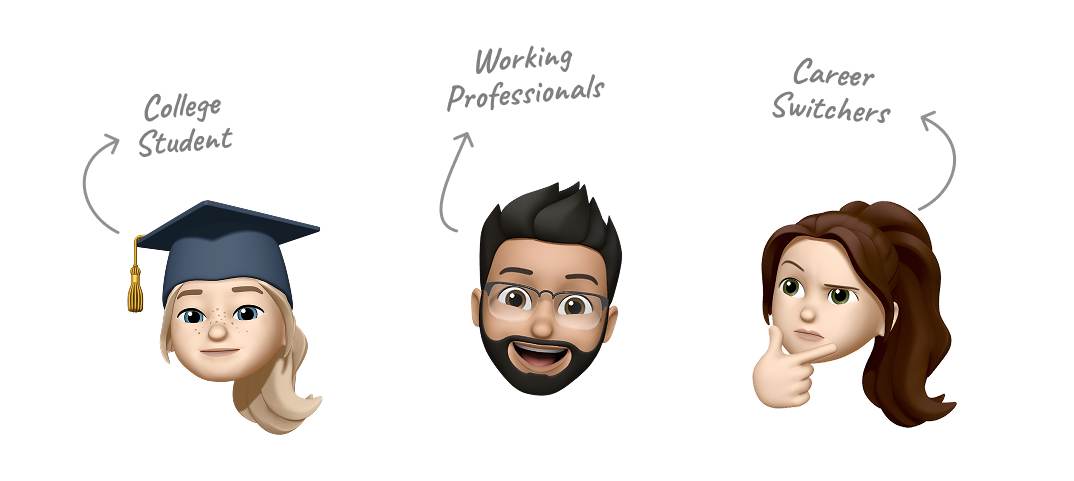

Designed for college students seeking internships or entry-level positions in top finance and investment firms

Ideal for professionals looking to enhance their expertise and advance in their finance careers.

Perfect for those looking to transition into finance by strengthening their expertise

Please drop us a message here to help us resolve it.

Chat on

WhatsApp

Schedule

a Call

Leave

a Mail